General Issues on Information Disclosure

CBL Asset Management (the Company) is a company of the Citadele Group. The Citadele Group believes that sustainability means developing business with a long-term perspective and in line with environmental, social and economic goals. This implies respect for the natural environment, responsible and ethical practices in the decisions we make, the products we offer and the services we provide. The Company supports the kind of approach and acts within the business framework to achieve the Citadele Group`s goals on the domain of sustainability.

The Company provides sustainability-related information on the financial products it offers, while all sustainability information at the entity level is provided by the Citadele Group and is disclosed [here].

The Citadele Group and the Company continuously monitor changes in the business environment and legislation in order to provide up-to-date information to stakeholders.

Citadele Group`s Sustainability Strategy

Citadele recognises how our business decisions can impact the environment and society, both directly through our operations and indirectly through the projects we finance. The Citadele Group aims to minimise the negative and maximise the positive impacts of its activities on the environment and society, while managing environmental, social and governance (ESG) risks.

The Citadele Group's sustainability strategy is structured around the UN Sustainable Development Goals (SDGs) framework. The Citadele Group has identified five priority sustainability goals that are linked to business strategy, work on sustainability issues and that address the areas where the Citadele Group has the greatest opportunity to make a difference.

The five priority SDGs are:

- Good health and well-being (SDG 3).

- Affordable and clean energy (SDG 7).

- Decent work and economic growth (SDG 8).

- Industries, innovation and infrastructure (SDG 9).

- Climate action (SDG 13).

The Citadele Group is committed to aligning the climate change impacts of its activities and investment portfolio with the goals and timelines of the Paris Agreement. Citadele has set a target of net zero emissions from operations, including from financed emissions, by 2050. To achieve this goal, the Citadele Group will focus on:

- Reducing financed emissions.

- Carbon-neutrality in its office operations.

- Financing climate transition by providing green financing and investment opportunities.

Citadele Group has adapted its business strategy, governance, risk management and disclosure practices in line with legislative requirements and the expectations of regulatory authorities in relation to environmental and climate risks.

Further relevant information regarding the Citadele Group`s sustainability strategy and its relevant aspects is disclosed in the AS Citadele banka Annual Report 2024 and in ESG Policy. The Company supports the Citadele Group`s sustainability strategy contributing to its realization.

CBL Asset Management Sustainability Strategy

The Company has identified and prioritised three UN SDGs, which form the basis of our sustainability strategy and are implemented through asset management processes. There is the option to identify additional priority SDGs for each investment product to achieve better results through active management and taking into account client preferences.

SDG 7: Affordable and clean energy.

SDG 7: Affordable and clean energy. The Company believes that access to an affordable, reliable, and sustainable energy is crucial for social well-being and transitioning to green economy. The Company supports this shift through investments in renewable energy resources, in companies implementing the usage of clean energy technologies and infrastructures, etc.

SDG 8: Decent work and economic growth.

SDG 8: Decent work and economic growth. The achievement of the goal is highly dependent on social and employee issues. The Company is supporting investee company’s and society`s efforts towards decent work conditions and economic growth.

SDG 13: Climate action.

SDG 13: Climate action. Climate change is one of the toughest problems to be solved. The Company is contributing to the process by considering in the asset allocation process the investee company’s efforts to combat climate change by reducing the use of fossil fuels, improving the energy and greenhouse gas intensity of its business activities, etc.

The process of integrating SDG and relevant parameters depend on the investment strategy and may vary depending on the financial product. Further information could be found on the website of each investment product.

CBL Asset Management is signatory to Principles for Responsible Investment

As a sign of its commitment to responsible investment, the Company signed the United Nations-supported Principles for Responsible Investment (PRI) in June 2019. Consequently, the Company undertook to respect the following six principles:

- To incorporate the ESG issues into investment analysis and decision-making processes.

- Be active owners and incorporate the ESG issues into ownership policies and practices.

- To seek appropriate disclosure on ESG issues by the entities in which we invest.

- To promote acceptance and implementation of the PRI within the investment industry.

- To cooperate with the signatories to enhance our effectiveness in implementing the PRI.

- To report on activities and progress towards implementing the PRI.

The Company prepares PRI reports to disclose its progress and plans for future periods in the area of sustainability, in accordance with the rules and timetable set by the PRI.

Sustainability Risk Integration into Decision-making Process at CBL Asset Management

The Company considers that sustainability factors may affect the long-term value of the Company's investments and agrees that integrating ESG aspects into asset management increases or maintains investment returns over the long term at a lower overall level of risk. Furthermore, integrating ESG aspects into the management of the investment portfolio contributes to the sustainable development of the world.

Sustainable investment standards and approaches are currently evolving rapidly, driven by changes in legal and regulatory requirements. We keep abreast of these changes, build on our experience in integrating ESG factors into investment decision-making, and adhere to the principles contained in our Sustainability and Engagement Policy, which can be found in the "Documents" section below.

We are aware of the greenwashing risk in the investment process due to the application of ESG criteria. Greenwashing is creation of a false impression or provision of misleading information that causes or may cause an investor to believe that the relevant investment products are environmentally friendly or have a greater positive impact on the environment than they actually have. To avoid the risk of greenwashing, the Company strictly complies with legal and regulatory requirements as well as risk management standards and policies of the Company and the Citadele Group.

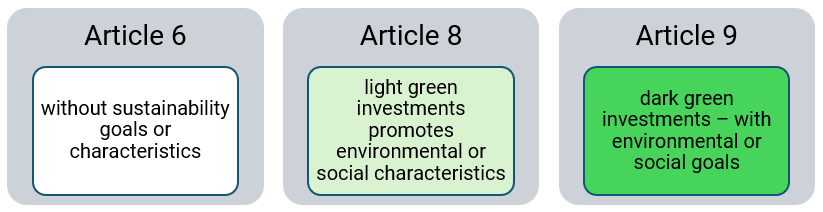

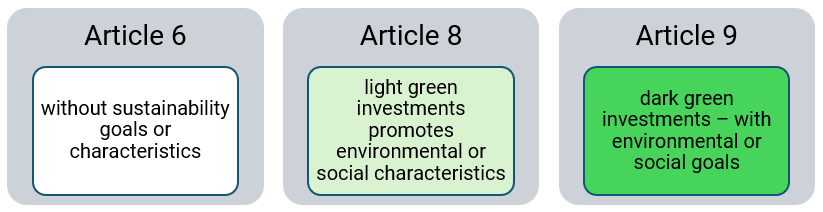

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27.11.2019 on sustainability‐related disclosures in the financial services sector (SFDR) requires investment fund managers to classify each investment fund they manage as a financial product under Articles 6, 8 or 9 of the SFDR and disclose certain information in accordance with this indication to provide investors with greater transparency before making an investment. SFDR classification means:

- A financial product under Article 6 of the SFDR – an investment fund without a sustainable investment objective and without obligations regarding investments in assets with environmental and/or social benefit, i.e., an investment fund that is not classified as an investment fund under Articles 8 or 9 of the SFDR.

- A financial product under Article 8 of the SFDR (so-called light green financial product) – an investment fund that promotes investments with a beneficial impact on environmental and/or social characteristics. Such promotion may include the assessment of certain adverse environmental and social impacts or the use of a relevant rating when making investment decisions.

- A financial product under Article 9 of the SFDR (so-called dark green financial product) – an investment fund aimed at sustainable investments that contribute to environmental and/or social goals without significantly harming other environmental objectives and in line with good governance practices.

In view of current trends in global stock markets, lower investment diversification opportunities and the lack of complete, timely and reliable sustainability data, the Company has so far reclassified two investment funds and one pension plan as Article 8 or "light green" funds – CBL Global Emerging Markets Bond Fund, CBL European Leaders Equity Fund and Sustainable Opportunities Investment Plan. These funds incorporate ESG factors significantly more in their investment decisions and the principal adverse impacts on sustainability factors are disclosed annually for both funds, as required by the SFDR.

In order to comply with the applicable regulatory requirements, the Company has prepared a description of the integration of sustainability risks into the decision-making process in the management of its financial products. In addition, the managers of each product also follow the process of integrating sustainability risks into the decision-making process as described in the Company's internal documents.

Integration of sustainability risks in CBL Global EM Bond Fund [investment fund under Article 8 of the SFDR]

Based on an internal assessment of the risk materiality, the Company concluded that the materiality of the ESG risk was low and that no further involvement in its management would be required. However, the Company believes that the integration of sustainability factors into the management process of the CBL Global Emerging Markets Bond Fund allows us to provide added value to investors who are willing to invest in financial instruments that promote sustainability and contribute to the achievement of prioritised UN SDGs that are at the core of our sustainability strategy and which we implement as part of our asset management processes. This bond fund has been chosen to promote environmental and social characteristics because the importance of ESG risk is more significant in emerging markets compared to developed markets.

The investment process of the fund is based on the fundamental analysis and creditworthiness analysis of issuers. In addition to traditional financial analysis, ESG factors are used in the overall assessment, resulting in an internal rating for each issuer. Fund managers and analysts are responsible for the fundamental and creditworthiness analysis of issuers and for the systematic integration of ESG factors into the overall assessment.

The following principles are applied in setting up the Fund:

1. Exclusion and Engagement

Exclusion of economic sectors or bond issuers where it is clear that an issuer does not follow the principles of sustainability or if its business activities involve products that are harmful to the environment or society (e.g. business activities related to pornography, controversial weapon production, etc.)

The Company carries out engagement activities with companies that lack any of the following policies:

- Prevention of accidents at work.

- Protection of whistleblowers.

- Human rights.

- Anti-corruption and anti-bribery.

If issuers do not remedy the deficiencies within 12 months since the time of engagement, they will be excluded from the investment list.

2. Rating Assignment and Assessment

- Each issuer is assigned a credit rating based on business analysis and financial data.

- A credit rating is adjusted on the grounds of ESG factors.

The Company uses data on ESG factors from external suppliers and translates this data into an issuer's internal rating using a model developed by the Company. Based on the internal rating assigned by the Company, which also includes ESG factors, we assign what we believe is a fair evaluation of each particular bond. In general, lower ESG risks lead to a higher internal rating and a correspondingly lower and fair risk premium, and vice versa.

The process can only be fully implemented if a certain amount of ESG data is available for the issuer. We have observed that the amount of available data is steadily increasing and the quality of the data is improving.

3. Creation of a portfolio

For comparable investment alternatives, we use the best-in-class approach and choose the bond issue whose issuer shows better results or dynamics in the following indicators:

- The share of non-renewable energy consumption in an investee company compared to renewable energy resources.

- The intensity of greenhouse gas (GHG) emissions of an investee company.

- The average human rights performance indicator.

- The average corruption score.

Further information regarding the risk integration process and its implication to achieve the prioritised UN SDGs is disclosed in the document “Pre-contractual disclosure Sustainability 01 2023 v1” here.

The Fund has no sustainable investment objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

Integration of sustainability risks in CBL Eastern European Bond Fund [investment fund under Article 6 of the SFDR]

Our investment process is based on an analysis of the creditworthiness of issuers. In addition to traditional financial analysis, we systematically integrate ESG factors into the overall analysis to assign an internal rating to a specific issuer. Fund managers and analysts are responsible for analysing the fundamentals and creditworthiness of issuers and systematically integrating ESG factors into the overall assessment.

The following principles are applied in setting up the Fund:

- Exclusion of multiple bond issues or sectors if the issuing organisation does not comply with sustainability principles, e.g. business activities related to pornography, controversial weapons production, etc.

- Each issuer initially receives its credit rating based entirely on its financials, while at the final stage we adjust the credit rating based on its ESG factors. We use data on ESG factors provided by external suppliers and convert that data into the adjusted internal rating for the issuer with the help of our proprietary model.

- Based on our adjusted internal rating, we arrive at our proprietary intrinsic value for a particular bond. All in all, lower ESG risks contribute to higher overall internal rating and consequently lower intrinsic credit spread, and vice versa.

Pre-contractual disclosure for CBL Eastern European Bond Fund is available in the document “Pre-contractual disclosure Sustainability 01 2023 v1” here.

The Fund has no sustainable investment as its objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

Integration of sustainability risks in CBL European Leaders Equity Fund [investment fund under Article 8 of the SFDR]

The fund's investment process is based on financial and technical analysis of company shares. In addition, the Company systematically integrates ESG factors into the overall analysis. The Company uses data on ESG factors from external data providers and, with the help of a model developed by the Company, converts this data into the company's internal rating. This is the basis for making the final investment decision.

The following principles are applied in setting up the Fund:

1. Exclusion and Engagement

Exclusion of economic sectors or companies where it is clear that they do not follow the principles of sustainability. For example, we do not include into our portfolio businesses that are related to pornography, production of controversial weapons, etc. A company shall be excluded if there is information that the company is related to:

- Controversial weapons.

- Convictions for violations of anti-corruption & anti-bribery laws.

- Major incidents of discrimination leading to sanctions.

The Company carries out engagement activities with companies that lack any of the following policies:

- Anti-corruption & anti-bribery.

- Human rights.

- Whistleblower protection.

We will exclude these companies from the investment list and the Fund will not invest in them if they do not remedy the identified deficiencies within 12 months of becoming involved.

2. Assigning Score and Assessing

Companies are evaluated based on a number of fundamental (for example, the company's profit growth dynamics, profitability and solvency indicators, the company's stock market value and earnings ratio, etc.) and technical factors (the company's stock price dynamics assessment), and the overall rating is adjusted by ESG indicators, improving the internal ranking of companies that are best-in-class in respect of the following categories:

- Scope 1, 2 and 3 GHG emission intensity.

- Water consumption intensity.

3. Creation of a Portfolio

Top 40-50 companies that score the highest on both fundamental, technical and ESG factors will be considered in the portfolio.

Further information regarding the risk integration process and its implication to achieve the pre-determined UN SDGs is disclosed in the following document: “Pre-contractual disclosure Sustainability 01 2023 v1” here.

The Fund has no sustainable investment as its objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

Integration of sustainability risks in CBL US Leaders Equity Fund [investment fund under Article 6 of the SFDR]

The fund's investment process is based on fundamental and technical analysis of company shares. In addition, the Company integrates ESG factors into the overall analysis. The Company applies Exclusion approach. An economic sector or company is excluded if it blatantly fails to comply with sustainability principles, e.g. pornography, controversial weapons production, etc.

Pre-contractual disclosure for CBL US Leaders Equity Fund is available in the “Pre-contractual disclosure Sustainability 01 2023 v1” here.

The Fund has no sustainable investment objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

Integration of sustainability risks in Investment portfolios

The manager believes that ESG factors can influence the long-term risk profile and returns of the instruments included in the portfolio. Integrating ESG criteria into the portfolio management process requires the client’s pre-contractual consent based on a good understanding of the risks associated with sustainable investments. When assessing the client’s investment goals and risk tolerance, the manager also evaluates the client’s sustainability preferences and understanding of the associated risks. Based on the information provided by the client the manager makes investment decisions by evaluating economic, financial and other indicators, which may include ESG considerations. The high level of granularity in the regulatory framework regarding the client's sustainability preferences does not allow the manager to ensure an exact match as part of the security selection process, as the resources required to meet the client's sustainability preferences according to the classification set out in Article 2(7) of Commission Delegated Regulation (EU) 2017/656 are not economically feasible.

However, the Company believes that it is important to disclose to clients information about investments in financial instruments that promote sustainable development. In our view, these meet the following criteria:

- Investments in equity and debt securities with the ESG rating of negligible, low or medium ESG risk, according to procedures available in the Company's internal documentation.

- Investments in fund units that meet the requirements of Articles 8 or 9 of the SFDR.

The manager of a client's individual investment portfolio is responsible for providing the client with a regular report on the state of the investment portfolio, including information on the following sustainability indicators:

-

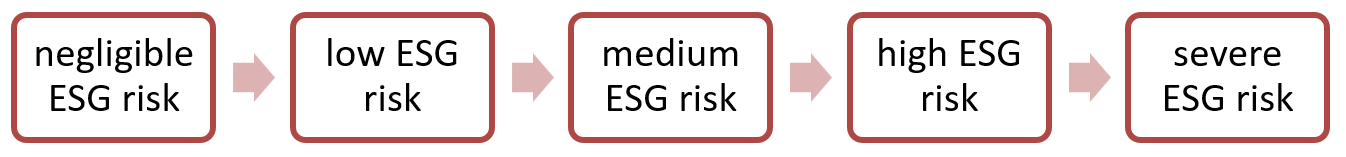

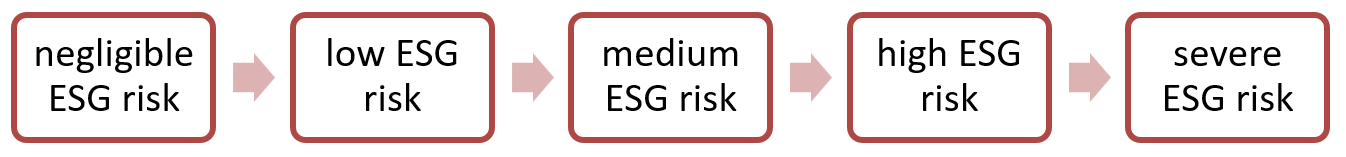

ESG risk indicator – reflects the level of ESG risk for debt and equity securities as assessed by a reliable third party. The risk level has the following five gradations:

-

SFDR classification – reflects the compliance of investment funds with Articles 6, 8 or 9 of the SFDR

Further information regarding the risk integration is disclosed in the following document “Pre-contractual disclosure Sustainability 01 2023 v1” here.

Integration of sustainability risks in Fund of Funds [investment under Article 6 of the SFDR]

The integration of ESG risks is a part of the overall analysis and decision-making process while managing the Fund of Funds. The investments of funds of funds are deemed sustainable by the Company if the Fund`s Managing Company has signed the UN PRI, confirming the commitment to make responsible investments. If the Fund lacks this criteria, engagement measures are taken.

Pre-contractual disclosure for investments in Fund of Funds is available in the “Pre-contractual disclosure Sustainability 01 2023 v1” here.

The product mentioned above has no sustainable investment as its objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

Integration of sustainability risks in pension products [investment under Article 6 of the SFDR]

The Company while managing the state-funded pension investment plans (2nd pillar) and 3rd pillar pension plans considers the ESG risks within the management process and ESG factors integration in the decision-making process includes:

- For pension plans whose assets are invested in fund units, the process is as mentioned in the paragraphs above: “Integration of sustainability risks in Fund of Funds”,

- For pension plans whose assets are invested in bonds, the process is as mentioned in the paragraphs above: “Integration of sustainability risks in CBL Eastern European Bond Fund”,

- For pension plans whose assets are invested in shares, the process is as mentioned in the paragraphs above: “Integration of sustainability risks in CBL US Leaders Equity Fund”.

Pre-contractual disclosure for investments in Pension Plans is available in the "Pre-contractual disclosure Sustainability 01 2023 v1" here (in Latvian).

Integrating sustainability risks into the CBL Sustainable Opportunities Investment Plan [investment under Article 8 of the SFDR]

The Company shall ensure that additional ESG factors are considered in the investment selection and management process when managing the CBL Sustainable Opportunities Investment Plan:

- The fund management company is a signatory to the UN PRI.

- At least 80% of the Plan's investments in financial instruments are assessed against the equity funds' compliance with the requirements of Articles 8 or 9 of the SFDR for investment products and the equity fund's name includes terms related to "sustainability", "environment" or "impact" that exclude investments in a range of activities that are harmful to society or the environment.

- Where compliance with the above requirements cannot be ensured for more than three consecutive months, the financial instruments shall be sold within a reasonable period of time.

This is the positive or best selection, which through their investments promotes environmental or social characteristics or have sustainability objectives and excludes investments in activities that are harmful to the environment or society. The investment process gives preference to investments that promote decent jobs and reduce the impact of climate change.

The pension plans managed by CBL has no sustainable investment as its objective within the meaning of the SFDR and it does not make investments aligned with the EU taxonomy.

The principle adverse impacts of investment decisions on sustainability factors are considered in the management of the Article 8 investment funds CBL Global Emerging Markets Bond Fund and CBL European Leaders Equity Fund.

The Company decided to consider principal adverse impacts of investment decisions on sustainability factors and to prepare an annual periodic report on those investment funds that meet the requirements of Article 8 of the SFDR. The process of preparing the report is based on the principal adverse impact reports of the respective investment funds and data from reliable third parties.A methodology to consider principal adverse impacts of investment decisions on sustainability factors is an integral part of the ESG risk integration process. Periodic sustainability information is published on the website of each financial product:

CBL Global Emerging Markets Bond Fund

CBL European Leaders Equity Fund

Sustainable Opportunities Investment Plan (in Latvian)

The methodology to consider principal adverse impacts of investment decisions on sustainability factors contains the necessity to engage with the companies issuing the financial instruments. The engagement process is provided in line with the requirements mentioned in Sustainability and Engagement Policy. Moreover, the Company disclosures its engagement activities on the annual basis in the Report on the Implementation of the Engagement Policy, that could be found below in the "Documents" section.

The Company supports the Paris Agreement and UN Framework Convention on Climate Change, as it recognizes a critical need to rush the transition towards global net zero emissions. As an asset manager we are considering playing our part to help deliver the goals of the Paris Agreement, but currently the Company has no net-zero investment products.

The Company supports the Task Force on Climate-Related Financial Disclosures. We are evaluating the opportunities to include the forward-looking information on the material financial impacts of climate-related risks and opportunities in our decision-making process. As soon as the Company has access to all the relevant data within our investment universe, we are going to evaluate the relevance of the introduction and compliance with Task Force on Climate-Related Financial Disclosures principles.

No consideration of principal adverse impacts of investment decisions on sustainability factors when managing the investment funds and pension plans under Article 6 of the SFDR

The Company regularly monitors ongoing changes in market practices, regulation and data availability to systematically assess whether it is possible to consider principal adverse impacts of investment decisions on climate and other environmental issues, as well as social, labour, human rights, anti-corruption and anti-bribery issues.

Unfortunately, the investment segment, in which the company mainly operates, still lacks high-quality, timely and systematic data on these issues, and has limited resources to fully consider the principal adverse impacts on sustainability factors into our investment decisions and financial advice. For this reason, CBL Asset Management cannot comprehensively assess principle adverse impacts of investment decisions on sustainability factors at entity level and only does so for SFDR Article 8 investment funds. Our position will be adapted to consider principal adverse impacts throughout the investment process as soon as it can be meaningfully and practically implemented.

Documents

Sustainability and Engagement Policy (February 2026. Version 7.0)

Engagement Policy Implementation Statement (2024, Version 1.0)

Engagement Policy Implementation Statement (2023, Version 1.0)

Report on the Implementation of the Engagement Policy (2022, Version 1.0)

Description of remuneration policy

CBL funds Sustainability

Information updated on April 11, 2025